The Hidden Influence of Taxation on British History

The fifth lecture in the Glasgow and West of Scotland Branch: talk on "The hidden influence of taxation on British history" by Matthew Elliott, Chief Executive of the TaxPayers' Alliance.

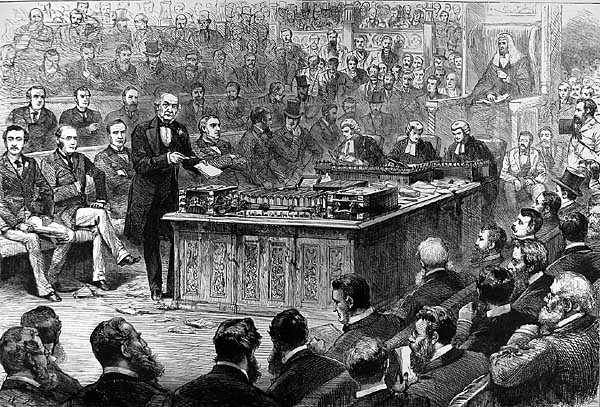

The Secretary introduced Mathew Elliott as the co-founder of the TaxPayers' Alliance, a campaigning pressure group. She compared it to the Anti Corn Law League, and wondered if Elliott and Wallace were the new Cobden and Bright. History - like philosophy - is about asking questions. So, if we ask about taxation - is it to fund the institutions of state or to redistribute wealth or to maintain a greedy oligarchy, - how does it affect the historical narrative?

Matthew began his survey of taxation in Britain with rebellion against invaders: Boudica against the Roman invaders, and the Anglo-Saxons against Danegeld. Then the story was one resistance to home-made tyrants. Robin Hood, ‘a model member of the Tax Payers alliance' (said Matthew), held out against the unscrupulous King John. In 1381 the Peasants' Revolt rebelled against Edward III's apparently unjust imposition of the third poll tax, allegedly to pay for the Hundred Years' War, although historians might argue that this was less about taxation than an attempt by the king to prevent labourers getting higher wages in the wake of the Black Death. Undeterred by the failure of the Peasants' Revolt, Jack Cade led a rebellion (1450), again against taxes to pay for the continuing war against France, but the rebellion had more to do with corruption and poor government.

Fast forward to the Tudors, contrasting Henry VIII (greedy for taxes), and Elizabeth I (more restrained). The Stuarts' need to raise taxes was considered in the context of growing power of parliament, determined to control spending. This coincided with the rise of Puritanism, and so taxation became entwined with religion. The monarch's attempt to bypass parliament by raising taxes with ship money led to the Civil War. From 1660 income tax might have been introduced but hearth tax and window tax became substitutes. To appease his friends and reduce land tax, Walpole promoted the idea of excise duties, but this provoked rebellion by merchants and traders, and eventually by the American colonies. Income tax was introduced in 1799 to pay for war - the one against Napoleon. Both Gladstone and Disraeli promised to repeal income tax, just like the Corn Laws, but neither did. The introduction of old-age pensions by Lloyd George raised the question of super-tax on the rich, but it was World War I that pushed up income tax from 6% in 1914 to 30% in 1918, thus setting the trend for the 20th century. Subsequent squabbles about poll (council) tax were just another facet of ways to use local taxation to supplement PAYE, itself a consequence of war - World War II.

The questions that followed focused almost entirely on the current consequences of credit crunch and the required taxation or cuts to pay for it. Matthew's poster indicated £30,000 per family.

Attendance 32